Australia plans reforms to tackle digital wallets and cryptocurrency regulations

The treasurer has warned that if the country doesn’t introduce reforms, it will be Silicon Valley that determines the future of the sector

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

Australia is set to introduce new regulatory proposals focused on cryptocurrency, buy now pay later (BNPL) and digital wallets, warning that if the country doesn’t bring in the reforms, it will be Silicon Valley that determines the future of its payments system.

The country’s treasurer Josh Frydenberg stated that Australia’s regulatory architecture needs to adapt, with greater strategic direction needed from the government. The current regulatory framework governing the payments system has remained largely unchanged over the last 25 years.

By mid-2022, the government aims to have set out a strategic longer-term plan for the payments system and settled details of additional powers for the treasurer to set payment system policy.

It is also looking to determine the changes necessary to modernise the payments system legislation to accommodate new and emerging payment systems, including BNPL platforms and digital wallets, like Google Pay and Apple Pay.

When it comes to cryptocurrency, the government is aiming to have completed a consultation on the establishment of a licencing framework for digital currency exchanges to provide greater confidence in the trading of crypto assets and to have received advice from the Council of Financial Regulator on the underlying causes and policy responses to the issue of de-banking.

By the end of 2022, the government aims to have settled the framework to replace the current one-size-fits-all payment licensing arrangements with a functionality based framework adopting graduated, risk-based regulatory requirements.

RELATED RESOURCE

How to reduce the risk of phishing and ransomware

Top security concerns and tips for mitigation

It will have also received a report from the Board of Taxation on an appropriate framework for the taxation of digital transactions and assets and received advice from the Treasury and the Reserve Bank of Australia on the feasibility of a retail Central Bank Digital Currency (CBDC) in Australia.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

“This is a substantial and complex body of work that will cement Australia’s position as a global finance and technology hub, locking in our economic recovery and setting Australia up for next year and well beyond,” said Frydenberg.

The reserve banks of Australia, Singapore, Malaysia, and South Africa are currently testing the use of CBDCs for international settlements in the hopes that it will reduce the time and costs for these types of transactions. The project, named Dunbar, aims to develop a prototype shared platform for cross-border transactions using multiple CBDCs.

Zach Marzouk is a former ITPro, CloudPro, and ChannelPro staff writer, covering topics like security, privacy, worker rights, and startups, primarily in the Asia Pacific and the US regions. Zach joined ITPro in 2017 where he was introduced to the world of B2B technology as a junior staff writer, before he returned to Argentina in 2018, working in communications and as a copywriter. In 2021, he made his way back to ITPro as a staff writer during the pandemic, before joining the world of freelance in 2022.

-

Salesforce targets telco gains with new agentic AI tools

Salesforce targets telco gains with new agentic AI toolsNews Telecoms operators can draw on an array of pre-built agents to automate and streamline tasks

-

Four national compute resources launched for cutting-edge science and research

Four national compute resources launched for cutting-edge science and researchNews The new national compute centers will receive a total of £76 million in funding

-

Boomi snaps up former MuleSoft executive as APJ channel lead

Boomi snaps up former MuleSoft executive as APJ channel leadNews Global software veteran Jim Fisher will work to expand the company’s channel operations across the region

-

Why Microsoft Teams has only just launched in China

Why Microsoft Teams has only just launched in ChinaNews The tech giant has officially launched Teams via its local partner in China, after it was launched globally in 2017

-

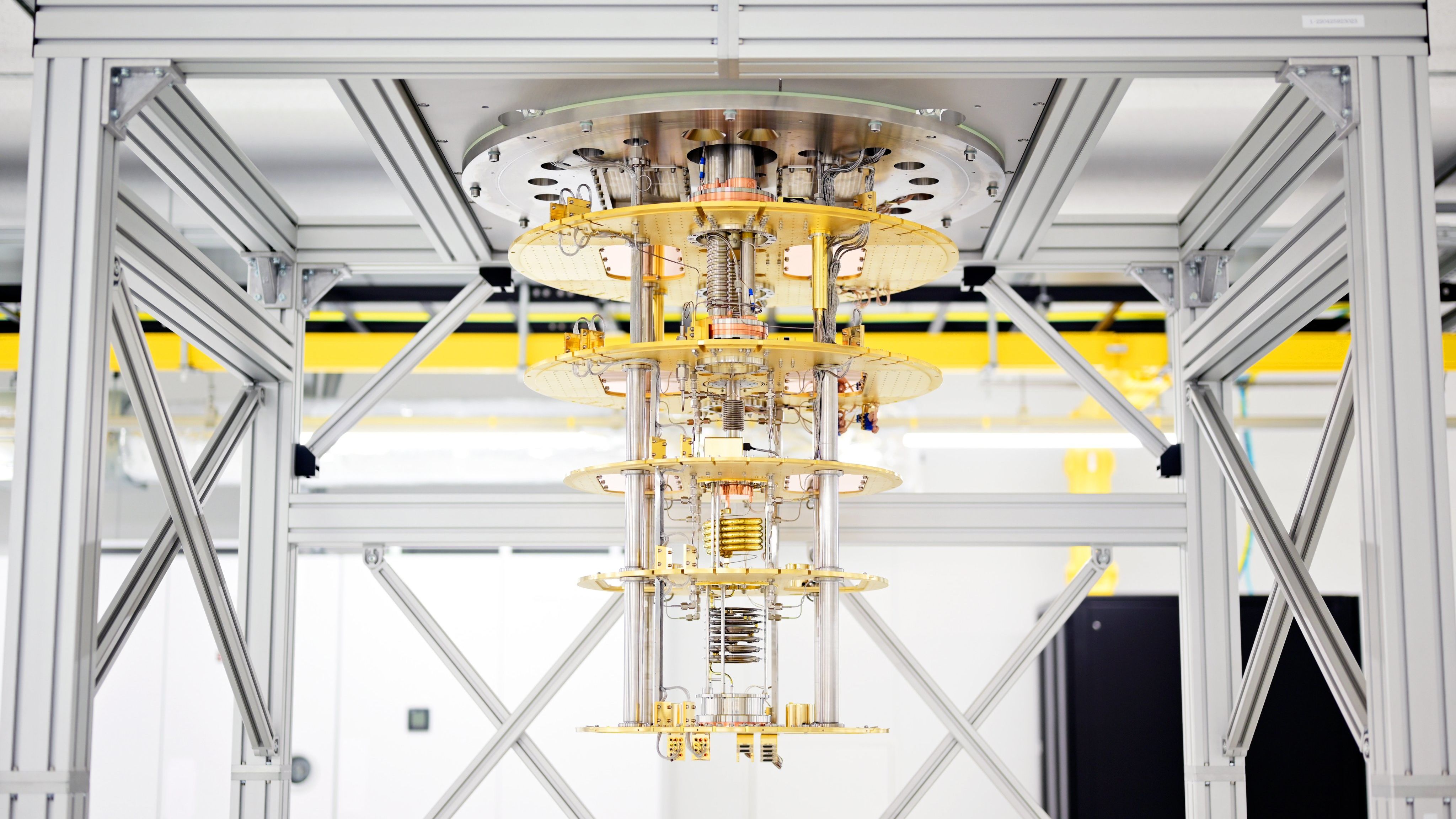

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix

-

MI5 to establish new security agency to counter Chinese hacking, espionage

MI5 to establish new security agency to counter Chinese hacking, espionageNews The new organisation has been compared to GCHQ’s NCSC, and will provide companies advice on how to deal with Chinese companies or carry out business in China

-

UK set to appoint second-ever tech envoy to Indo-Pacific region

UK set to appoint second-ever tech envoy to Indo-Pacific regionNews The role will focus on India after Joe White was made the first technology envoy, a role focused on the US, in 2020

-

Wipro faces criticism after cutting graduate salaries by nearly 50%

Wipro faces criticism after cutting graduate salaries by nearly 50%News Graduates were given days to decide whether they would accept greatly reduced pay offers, prompting union action

-

Freshworks appoints Sandie Overtveld as new SVP of APJ and MEA

Freshworks appoints Sandie Overtveld as new SVP of APJ and MEANews The digital transformation veteran brings years of regional expertise to lead Freshworks’ growth strategy

-

Suncorp signs three-year Azure deal to complete multi-cloud migration by 2024

Suncorp signs three-year Azure deal to complete multi-cloud migration by 2024News The financial services firm seeks to wind down its on-prem data centres and wants 90% of its workloads in the cloud by the end of the year