India to trial digital rupee from December 2022

The real-time performance of the CBDC could see India becoming one of the very countries in the world to adopt a nationwide digital currency

The Reserve Bank of India (RBI) is set to launch the country’s first pilot for retail digital rupee (e₹-R) on 1 December 2022 - a token that will constitute legal tender.

The RBI is hoping to test the robustness of a digital rupee, including its creation, distribution, and retail use in real time. After gathering this data from the pilot, future trials will test other features and applications of the digital currency.

During the pilot, select customers and merchants will form a closed user group that will test the performance and usability of e₹-R across different locations.

The digital token is set to be issued in the same denominations that the physical rupee comes in and would be distributed by intermediaries like banks.

Users will be able to transact the token through a digital wallet offered by the banks taking part in the pilot. Like other existing digital wallets, this will be stored on users’ mobile phones or other electronic devices.

The transactions can be made between users (person-to-person) and between a user and a merchant (person-to-merchant). Merchant payments will be facilitated through QR codes displayed by the merchant in their stores.

“The e₹-R would offer features of physical cash like trust, safety, and settlement finality,” said Yogesh Dayal, chief general manager at the RBI. "As in the case of cash, it will not earn any interest and can be converted to other forms of money, like deposits with banks."

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Eight banks are set to take part in the pilot which will initially be launched in Mumbai, New Delhi, Bengaluru, and Bhubaneswar. This will later be extended to Ahmedabad, Gangtok, Guwahati, Hyderabad, Indore, Kochi, Lucknow, Patna, and Shimla.

The first phase will start with four banks: State Bank of India, ICICI Bank, Yes Bank, and IDFC First Bank. Four other banks will then join the pilot: Bank of Baroda, Union Bank of India, HDFC Bank and Kotak Mahindra Bank.

The RBI said that the scope of the pilot could be gradually expanded to include more banks, locations, and users if needed.

RELATED RESOURCE

IT best practices for accelerating the journey to carbon neutrality

Considerations and pragmatic solutions for IT executives driving sustainable IT

India is aiming to launch the digital rupee, a central bank digital currency (CBDC), in a bid to boost its digital economy. In February 2022, the RBI said it would introduce the digital currency in either 2022 or 2023. The digital rupee was hoped to lead to a more efficient and cheaper currency management system, built on the blockchain and other technologies.

If fully implemented, India would join China as one of the few countries with a nationwide digital currency. At an international level, several world banks are running CBDC trials too.

In October 2022, several banks successfully completed trials of a blockchain platform designed to encourage faster adoption of CBDCs across global banks. The banks that took part in the project were the Hong Kong Monetary Authority, the Bank of Thailand, the Digital Currency Institute of the People's Bank of China, and the Central Bank of the United Arab Emirates.

Zach Marzouk is a former ITPro, CloudPro, and ChannelPro staff writer, covering topics like security, privacy, worker rights, and startups, primarily in the Asia Pacific and the US regions. Zach joined ITPro in 2017 where he was introduced to the world of B2B technology as a junior staff writer, before he returned to Argentina in 2018, working in communications and as a copywriter. In 2021, he made his way back to ITPro as a staff writer during the pandemic, before joining the world of freelance in 2022.

-

Boomi snaps up former MuleSoft executive as APJ channel lead

Boomi snaps up former MuleSoft executive as APJ channel leadNews Global software veteran Jim Fisher will work to expand the company’s channel operations across the region

-

Why Microsoft Teams has only just launched in China

Why Microsoft Teams has only just launched in ChinaNews The tech giant has officially launched Teams via its local partner in China, after it was launched globally in 2017

-

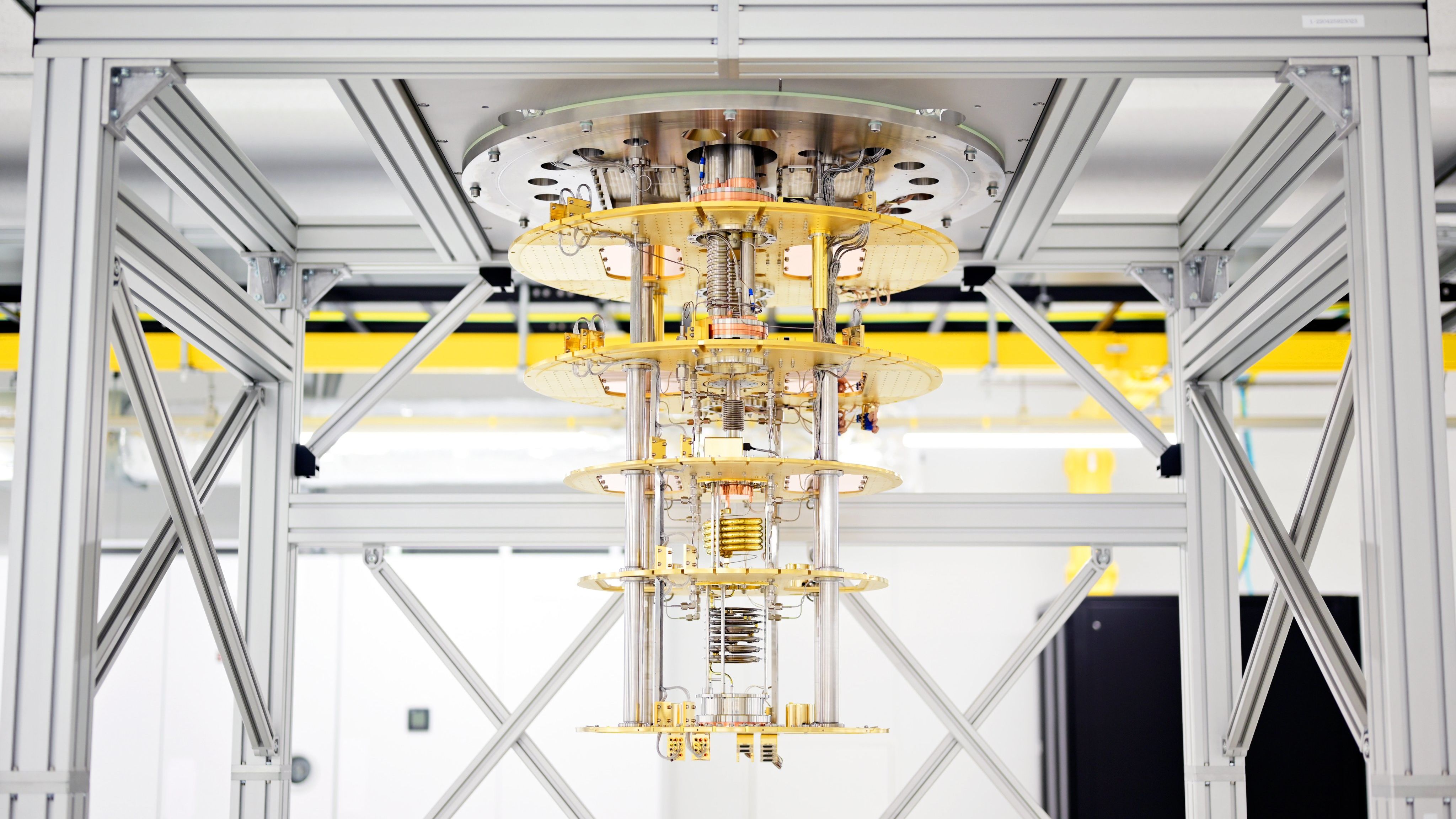

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix

-

MI5 to establish new security agency to counter Chinese hacking, espionage

MI5 to establish new security agency to counter Chinese hacking, espionageNews The new organisation has been compared to GCHQ’s NCSC, and will provide companies advice on how to deal with Chinese companies or carry out business in China

-

UK set to appoint second-ever tech envoy to Indo-Pacific region

UK set to appoint second-ever tech envoy to Indo-Pacific regionNews The role will focus on India after Joe White was made the first technology envoy, a role focused on the US, in 2020

-

Wipro faces criticism after cutting graduate salaries by nearly 50%

Wipro faces criticism after cutting graduate salaries by nearly 50%News Graduates were given days to decide whether they would accept greatly reduced pay offers, prompting union action

-

Freshworks appoints Sandie Overtveld as new SVP of APJ and MEA

Freshworks appoints Sandie Overtveld as new SVP of APJ and MEANews The digital transformation veteran brings years of regional expertise to lead Freshworks’ growth strategy

-

Suncorp signs three-year Azure deal to complete multi-cloud migration by 2024

Suncorp signs three-year Azure deal to complete multi-cloud migration by 2024News The financial services firm seeks to wind down its on-prem data centres and wants 90% of its workloads in the cloud by the end of the year