Cloud spending soars in financial services – but it's not all plane sailing for another key European industry

Overall public cloud spending in Europe is expected to reach $373 billion by 2028

The banking industry is ramping up cloud spending more than any other sector, according to new research, but other major sectors appear to be easing off the pedal.

Analysis from IDC shows public cloud spending in Europe will hit a total of $221 billion this year and is expected to reach $373 billion by 2028 - marking a five-year compound annual growth rate of 20%.

Platform as a Service (PaaS) will remain the fastest-growing area for cloud spending, IDC said, thanks to the increasing demand for AI applications, integration of cloud ecosystems, and the need for scalable platforms that can support firms' digital transformation.

Banking, software and information services, and insurance will be the industries with the fastest year-on-year spending increases in 2025, IDC noted.

In the case of banking, this is thanks to threat intelligence requirements that are pushing companies to build AI tools that can rapidly categorize and summarize data and identify potential threats.

Meanwhile, last year’s strong investments in data centers across Europe will mean more cloud spending on generative AI and other technologies for risk assessment, customer service, and back-office process optimization.

Cloud spending gains face significant barriers

However, IDC said potential new US tariffs and trade tensions with the European Union, persistent economic weakness in Germany, and growing competition from China may create challenges for some European industries.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

With Europe's economic growth in 2025 likely to remain shaky, consumer and business confidence could suffer, impacting budgets dedicated to cloud-based transformation projects.

"Manufacturing industries, especially chemicals and automotive, are paying the effects of prolonged supply chain disruptions, lower demand, skill shortage, and tough global competition," said Andrea Minonne, research manager at IDC UK.

"Deteriorating business confidence will slow down cloud spending, which will still grow, but at a slower place compared with verticals like banking or software and information systems."

Looking ahead, IDC said software and information services are set to have the highest value compound annual growth rate in Europe between 2023 and 2028, standing at 24%.

RELATED WHITEPAPER

This spending growth will be fueled by rising demand for AI and generative AI solutions, increased investments in cybersecurity research and development, and the adoption of scalable SaaS solutions.

Insurance and life science will also grow their public spending more rapidly than other verticals, said IDC. Insurance firms will be investing in public cloud to modernize their core systems, automate operations, and integrate AI-driven risk management to improve compliance, efficiency, and customer experience.

Meanwhile, despite near-term supply constraints and manufacturing limitations, life sciences companies are investing in AI-driven drug discovery, expanding production capacity and strengthening digital supply chain resilience.

"Cloud is a growing market and investments will be driven to support automation and tech such as AI and generative AI," said Minonne.

MORE FROM CLOUDPRO

- Data center hardware spending surged last year

- UK banks are scrambling to comply with DORA regulations

- Financial services firms urged to bolster security capabilities

Emma Woollacott is a freelance journalist writing for publications including the BBC, Private Eye, Forbes, Raconteur and specialist technology titles.

-

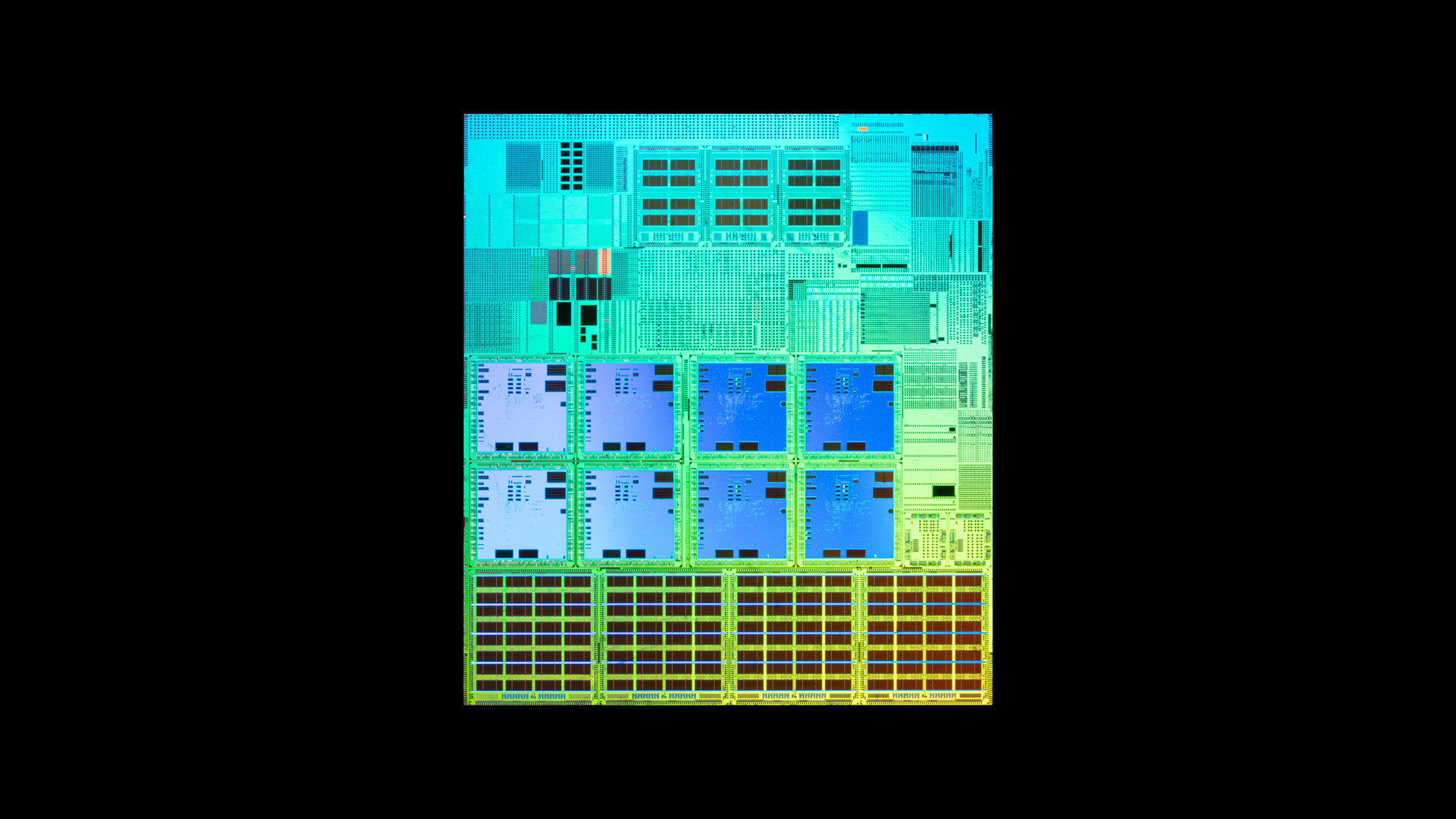

What is Microsoft Maia?

What is Microsoft Maia?Explainer Microsoft's in-house chip is planned to a core aspect of Microsoft Copilot and future Azure AI offerings

-

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using it

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using itOpinion If Satya Nadella wants us to take AI seriously, let's start with ROI for businesses

-

Wasabi Technologies wants to be a "more predictable alternative to the hyperscalers" after $70m funding round

Wasabi Technologies wants to be a "more predictable alternative to the hyperscalers" after $70m funding roundNews The cloud storage provider plans to ramp up AI infrastructure investment and boost global expansion

-

Google Cloud teases revamped partner program ahead of 2026

Google Cloud teases revamped partner program ahead of 2026News The cloud giant’s new-look partner ecosystem shifts focus from activity tracking to measurable customer outcomes

-

Cloud security teams are in turmoil as attack surfaces expand at an alarming rate

Cloud security teams are in turmoil as attack surfaces expand at an alarming rateNews Cloud security teams are scrambling to keep pace with expanding attack surfaces, new research from Palo Alto Networks shows, largely due to the rapid adoption of enterprise AI solutions.

-

AWS re:Invent 2025 live: All the news and announcements from day two in Las Vegas

AWS re:Invent 2025 live: All the news and announcements from day two in Las VegasLive Blog Keep tabs on all the latest announcements from day-two at AWS re:Invent 2025 in Las Vegas

-

CEOs admit majority of cloud environments were ‘built by accident rather than design’ – and it’s coming back to haunt them

CEOs admit majority of cloud environments were ‘built by accident rather than design’ – and it’s coming back to haunt themNews Many enterprises rushed into the cloud without a clear end goal in mind, according to Kyndryl

-

Microsoft’s new ‘marketplace’ lets customers pick and choose cloud, AI solutions

Microsoft’s new ‘marketplace’ lets customers pick and choose cloud, AI solutionsNews The Microsoft Marketplace looks to streamline customer access to AI and cloud services

-

Mainframes are back in vogue

Mainframes are back in vogueNews Mainframes are back in vogue, according to research from Kyndryl, with enterprises ramping up hybrid IT strategies and generative AI adoption.

-

Google Cloud introduces ‘no-cost’ data transfers for UK, EU businesses

Google Cloud introduces ‘no-cost’ data transfers for UK, EU businessesNews Google Cloud's new Data Transfer Essentials service will allow enterprises to transfer data to alternative providers at no extra cost.