CMS grabs rival to create heavyweight storage distie

Firm aims for 20 percent growth with more acquisitions planned for next year

Stay up to date with the latest Channel industry news and analysis with our twice-weekly newsletter

You are now subscribed

Your newsletter sign-up was successful

Storage distributor CMS Peripherals has acquired rival CCI Distribution to create “the number one [independent] storage distributor in the UK,” according to Frank Salmon, founder and managing director of CMS Peripherals (pictured with Paul Roughley, MD of CCI.)

Salmon believes that the acquisition will help grow CMS from its current €145m annual turnover to over €250m. “It’s a start of a new journey for us and our first acquisition,” he explains. “Our core markets are similar but we serve different vendors and mainly different customers and the big opportunity is for each company to increase their portfolios giving us a better chance of achieving our growth targets in excess of 20 percent growth.”

The companies currently share only two vendors in common, Verbatim and HP, although CCI sells only HP “branded under license” products. The combined portfolio will now span nearly 70 vendors although Salmon believes that in the short term there will be no culling of the catalogue and both firms will be actively selling each other’s product lines. “We are not looking to consolidate or reduce the number of vendors but what we are looking to do is increase the number of customers to sell to,” explains Salmon.

The existing 1500 CMS resellers will join 1100 CCI resellers with only a 15 percent overlap. The firm will continue to grow that base, although Salmon admits the firm will also be targeting some of big storage vendors it doesn’t work with.

“One of the benefits that the combined company brings is to make us more attractive to vendors who in the past would normally would go with broadline or global distribution,” Salmon comments. “Brands like NetApp and EMC [but] there are also additional software brands like Linux…there will be several players later this year that will want to have a conversation with us about consolidation.”

The CMS founder strongly believes there is room for indigenous specialist distribution and the deal gives each firm “Northern and Southern,” offices to trade from. Both will continue to trade under separate brands although, “in 2012 we will look to seek additional acquisitions… I wouldn’t rule out in the future that we won’t come up with a different brand.”

Salmon feels that there is likely to be a continued consolidation across the distribution market. “The barriers to entry to distribution are far greater than they have ever been while the expectation of the buyers is higher than it has have ever been… having operational excellence is absolutely critical.”

Stay up to date with the latest Channel industry news and analysis with our twice-weekly newsletter

He points out the number of players has reduced through consolidation and that in his view distributors who don't have strong operational systems will fail. “Our competitors, the broadline companies, if they don’t evolve they will shrink and struggle… the same rule applies and what we are doing now is putting a stake in the ground and investing in our future.” he adds.

-

Give businesses more practical AI services and some return on investment before you go selling 6G

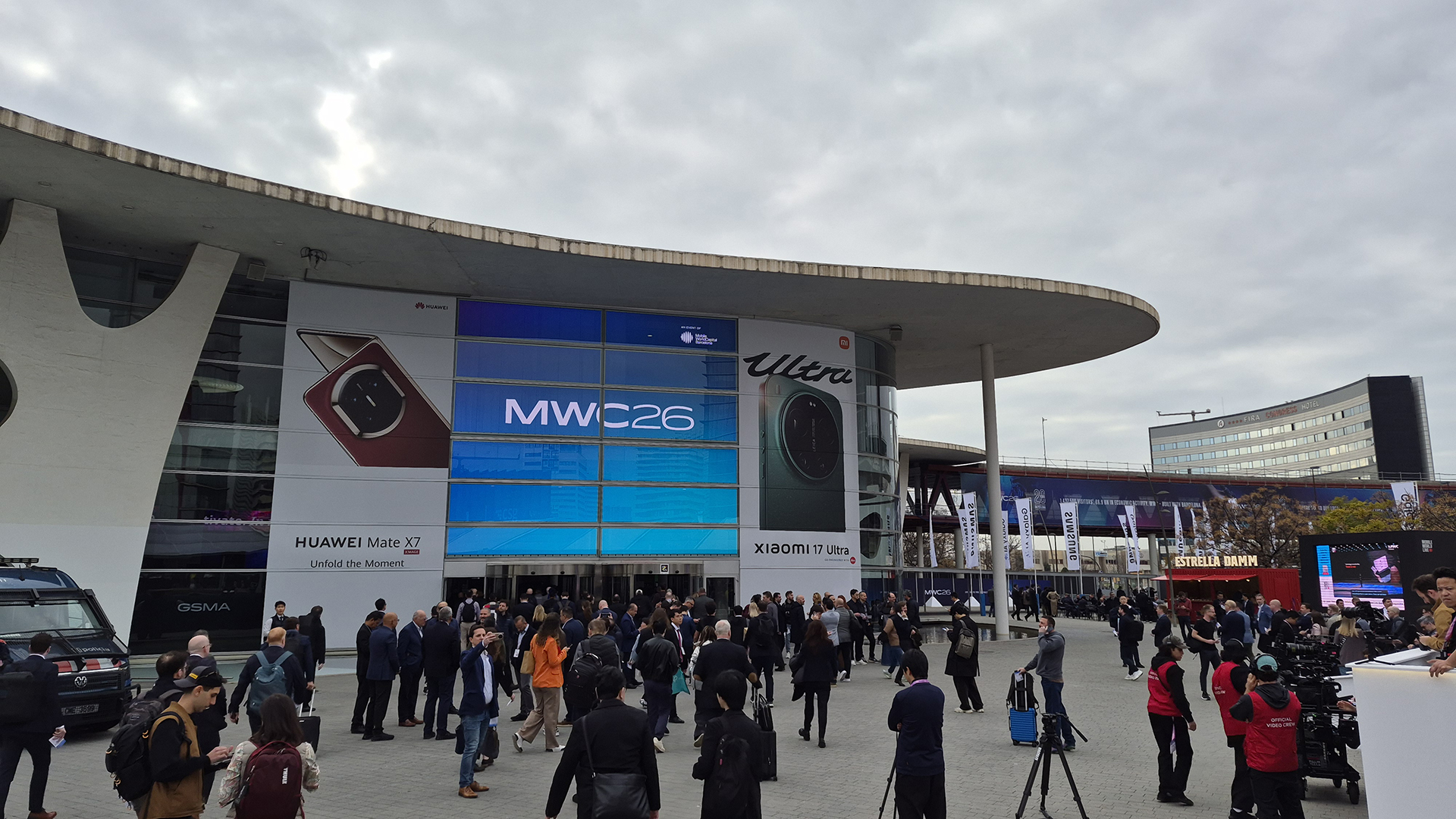

Give businesses more practical AI services and some return on investment before you go selling 6GThe value of modular computing and community-led development wins big at MWC, while AI continues to consume us all

-

Microsoft CEO Satya Nadella says 'anyone can be a software developer' with AI

Microsoft CEO Satya Nadella says 'anyone can be a software developer' with AINews AI will cause job losses in software development, Nadella admitted, but claimed many will reskill and adapt to new ways of working