European startups set to break investment record in 2020

Mega-funding rounds of more than $100 million have boosted the continent's tech industry amid economic uncertainty

European tech startups are tipped to raise a record $41 billion (£30.7 billion) of investment in 2020, despite the crippling economic impact of the coronavirus pandemic.

This is largely thanks to a series of "mega-funding rounds" of more than $100 million, according to a report from London-based VC firm Atomico.

The State of European Tech 2020 report suggests investment will grow marginally compared to the $40.6 billion raised in 2019. However, European startups have had a more positive 2020 than was expected after the first few months of the year.

This is partly due to the overall health of the industry, which has seen massive growth since 2016, coinciding with the so-called "mega-funding rounds".

"In November, Hopin set the record for Europe's fastest ever company to hit a billion-dollar valuation: 17 months from founding," the report noted. "We now have 115 VC-backed companies valued at over $1bn. Spotify and Adyen hit $50bn. $100bn valuations are starting to feel inevitable, not aspirational.

RELATED RESOURCE

"We no longer need to sell the European tech story to LPs. Institutional investors from Europe and around the world poured three times more money into Europe's tech industry than five years ago.

"As our ecosystem matures, the share of venture capital funding from government agencies is declining and now accounts for less than 10% of VC funds raised in Europe's most mature markets."

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The "mega-investment" rounds are a long way from the troubles many startups were in at the start of the pandemic. In April, most European governments were being called on to support lots of early-stage businesses that feared going bust without financial aid.

Nearly half of those who responded to the Atomico survey said they found it harder to get funding in 2020. This was made all the worse by the challenges that were forced upon them due to the pandemic, such as pivoting products and declining sales. As a result, their wellbeing ranked amongst their greatest concerns for 2020.

Bobby Hellard is ITPro's Reviews Editor and has worked on CloudPro and ChannelPro since 2018. In his time at ITPro, Bobby has covered stories for all the major technology companies, such as Apple, Microsoft, Amazon and Facebook, and regularly attends industry-leading events such as AWS Re:Invent and Google Cloud Next.

Bobby mainly covers hardware reviews, but you will also recognize him as the face of many of our video reviews of laptops and smartphones.

-

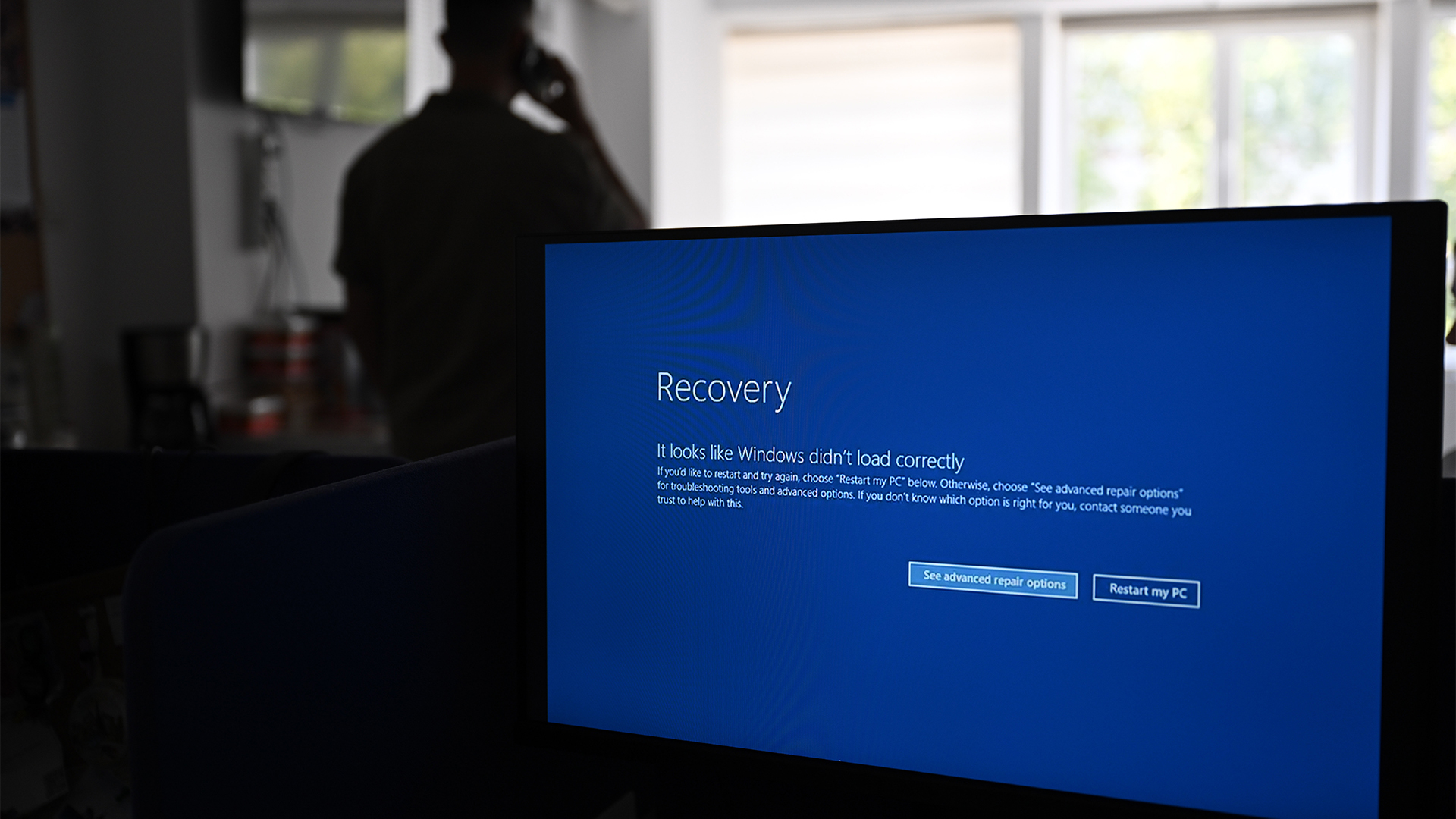

It's been two weeks since CrowdStrike caused a global IT outage – what lessons should we learn?

It's been two weeks since CrowdStrike caused a global IT outage – what lessons should we learn?Opinion The incident on 19 July was possibly the biggest IT outage to date

-

Game-changing data security in seconds

Game-changing data security in secondswhitepaper Lepide’s real-time in-browser demo

-

Unlocking the opportunities of open banking and beyond

Unlocking the opportunities of open banking and beyondwhitepaper The state of play, the direction of travel, and best practices from around the world

-

Accelerated, gen AI powered mainframe app modernization with IBM watsonx code assistant for Z

Accelerated, gen AI powered mainframe app modernization with IBM watsonx code assistant for Zwhitepaper Many top enterprises run workloads on IBM Z

-

Magic quadrant for finance and accounting business process outsourcing 2024

Magic quadrant for finance and accounting business process outsourcing 2024whitepaper Evaluate BPO providers’ ability to reduce costs

-

The power of AI & automation: Productivity and agility

The power of AI & automation: Productivity and agilitywhitepaper To perform at its peak, automation requires incessant data from across the organization and partner ecosystem.

-

Let’s rethink the recruiting process

Let’s rethink the recruiting processwhitepaper If you designed your recruiting process for a new company, what would you automate to attract and hire the best talent?

-

AI academy: Put AI to work for customer service

AI academy: Put AI to work for customer servicewhitepaper Why AI is essential to transforming customer service