UK leads Europe on VC investment despite Brexit uncertainty

UK startups raised £10.84 billion in 2020 to break funding records for the second year in a row

UK startups benefited from a record-breaking level of venture capital (VC) investment in 2020, despite difficult economic conditions created by Brexit and the global COVID pandemic.

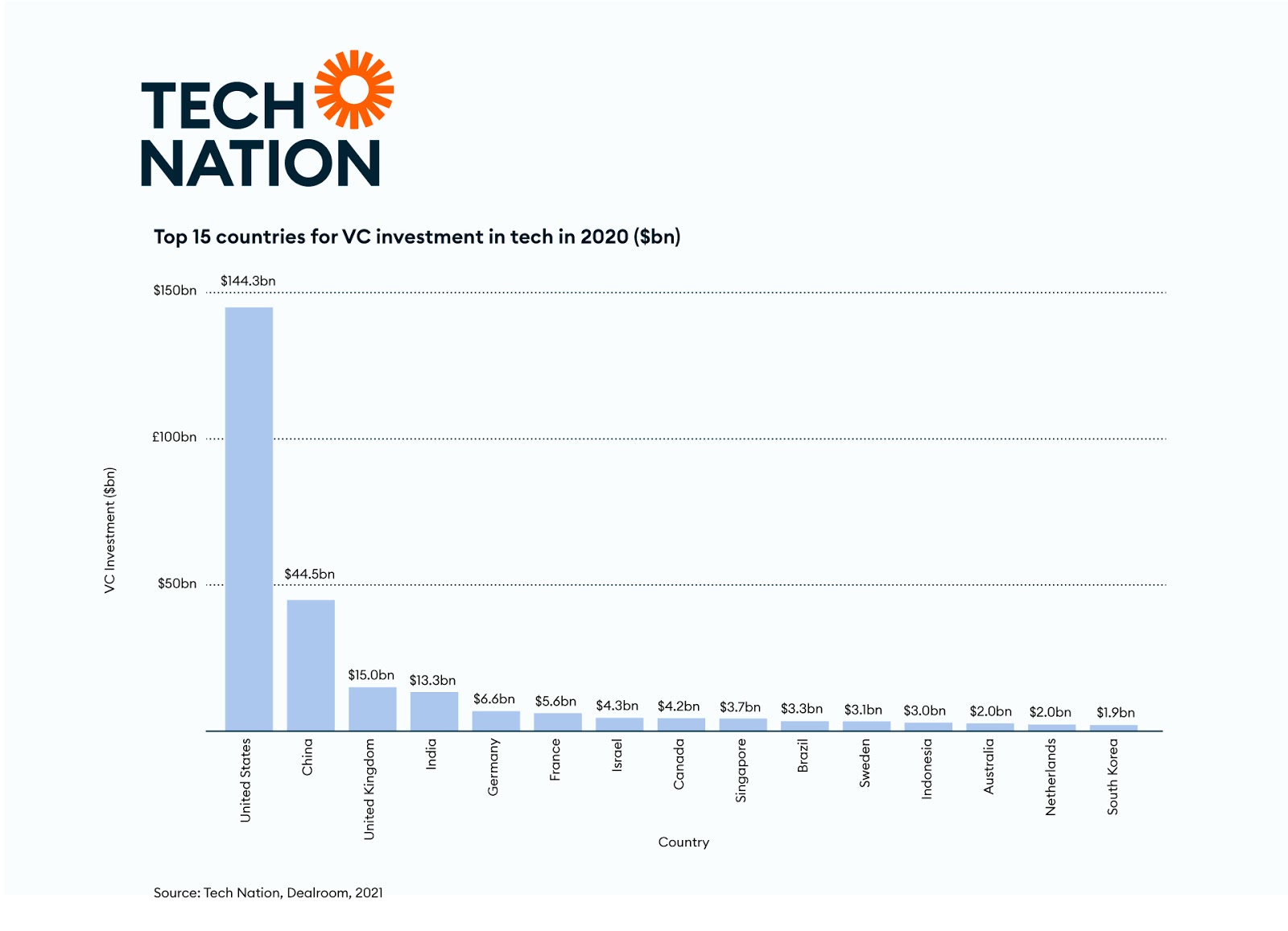

At $15 billion (£10.84 billion), the UK once again led Europe in VC investment in tech and was ranked third globally after the US (£104.33 billion) and China at (£32.25 billion), according to the latest report by Tech Nation.

The UK’s 2020 VC investment broke records for the second year in a row, having increased its investment by $200 million (£144.5 million) since 2019. In fact, the country made moves to close the gap with China, which faced a drop in investment in both 2019 (-50%) and 2020 (-3%).

Moreover, Brexit didn’t seem to hinder the UK’s ability to remain open to overseas investment. Last year, 63% of 2020 investment (£6.79 billion) in UK tech came from overseas, compared with 50% (£2.17 billion) in 2016. According to Tech Nation, overseas financing represented 84% of total investment at the $250m+ mark, up from 54% at Series A.

Tech Nation found that the UK’s investment gained momentum throughout the year, reaching a peak in December 2020. This growth was driven by UK tech hubs such as London, Oxford, Bristol, Edinburgh, and Cambridge – home to the UK’s ‘tech crown jewel’ ARM as well as startups such as FiveAI.

However, Tech Nation also warned that the UK must provide more support to regional tech clusters, as their collective strength can be credited with helping the nation achieve the title of a world-leading tech centre.

Despite this, the focus continues to be placed on London alone, with the percentage of total UK VC investment made in London increasing from 73% to 88% between 2018 and 2021. Tech Nation suggested that tech hubs outside of the capital should be supported by the development of more targeted regional investment funds.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Commenting on the report, Tech Nation founding chief executive Gerard Grech said that “in the face of a major global crisis, [the UK] has not only survived; in many areas, it has boomed”.

RELATED RESOURCE

MLOps 101: The foundation for your AI strategy

What is MLOps and why do you need an MLOps infrastructure?

“From EdTech to HealthTech, tech scaleups are at the centre of rebuilding the British economy and setting new standards worldwide,” he said, adding that “developing Britain’s AI-powered deep-tech is especially critical” for the UK’s future.

“Much of our future economy will be built on this new technology that leverages machine learning for faster innovation. Bold investment is needed in R&D to boost Britain’s new deep-tech companies and ensure our global competitiveness.”

Prime minister Boris Johnson said the UK “is maintaining its lead as one of the world’s premier centres for tech of all kinds”.

“While the real credit lies, as ever, with the engineers and designers toiling away at laptops across the country, I’m immensely proud to lead a government that is so comprehensively committed to supporting the sector. We’re continuing to invest in your success, and I hope that the winning combination of UK tech and this government will lead us to yet another record-breaking year in 2021,” he added.

Having only graduated from City University in 2019, Sabina has already demonstrated her abilities as a keen writer and effective journalist. Currently a content writer for Drapers, Sabina spent a number of years writing for ITPro, specialising in networking and telecommunications, as well as charting the efforts of technology companies to improve their inclusion and diversity strategies, a topic close to her heart.

Sabina has also held a number of editorial roles at Harper's Bazaar, Cube Collective, and HighClouds.

-

Redefining resilience: Why MSP security must evolve to stay ahead

Redefining resilience: Why MSP security must evolve to stay aheadIndustry Insights Basic endpoint protection is no more, but that leads to many opportunities for MSPs...

-

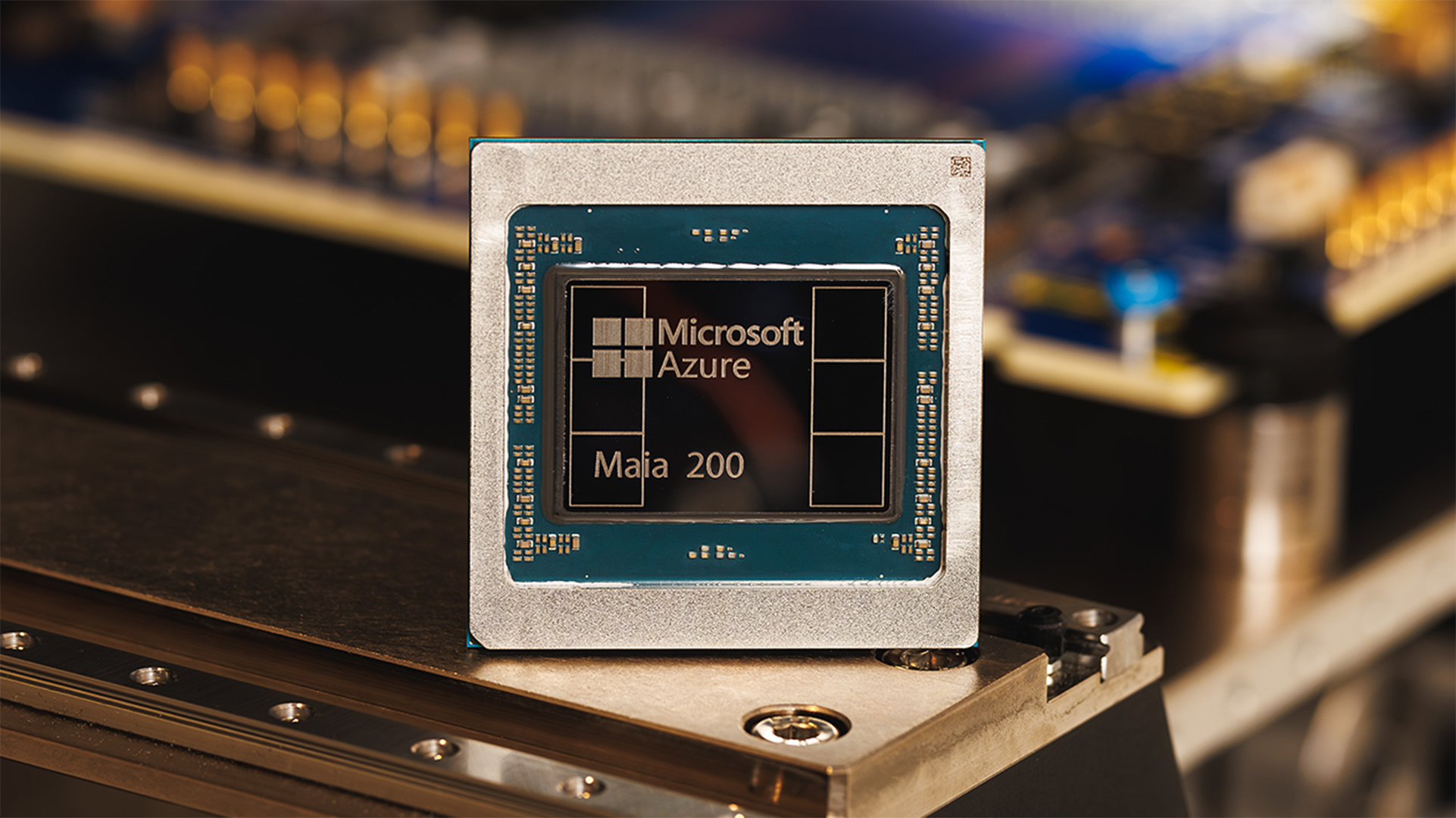

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and Google

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and GoogleNews The launch of Microsoft’s second-generation silicon solidifies its mission to scale AI workloads and directly control more of its infrastructure

-

Productivity gains on the menu as CFOs target bullish tech spending in 2026

Productivity gains on the menu as CFOs target bullish tech spending in 2026News Findings from Deloitte’s Q4 CFO Survey show 59% of firms have now changed their tune on the potential performance improvements unlocked by AI.

-

Why managing shareholders is key to innovation

Why managing shareholders is key to innovationIn-depth Seeking out investment for new technologies and seeing your ideas through requires continuous and measured trust-building

-

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?Analysis Plunging venture capital investment and warnings over high-growth company support raise doubts over the ‘Unicorn Kingdom’ ambition

-

Some Tech Nation programs could continue after Founders Forum acquisition

Some Tech Nation programs could continue after Founders Forum acquisitionNews The acquisition brings to a close a months-long saga over what the future holds for Tech Nation initiatives

-

Podcast transcript: Startup succession: From Tech Nation to Eagle Labs

Podcast transcript: Startup succession: From Tech Nation to Eagle LabsIT Pro Podcast Read the full transcript for this episode of the ITPro Podcast

-

The ITPro Podcast: Startup succession: From Tech Nation to Eagle Labs

The ITPro Podcast: Startup succession: From Tech Nation to Eagle LabsITPro Podcast Some small firms are already lamenting the loss of Tech Nation, but Barclays Eagle Labs has much to offer the sector

-

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never has

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never hasOpinion Tech Nation has a great track record, but Eagle Labs has the experience, the financial clout, and a clear-cut vision that will deliver positive results for UK tech

-

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditions

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditionsNews Tech Nation’s final piece of industry research calls for action to support continued ecosystem growth