Why digital resilience now belongs in the channel boardroom

Digital technologies are placing increased responsibility on channel boardrooms

For many years, digital resilience was treated as a remote IT issue. It sat with technical teams and tended to surface at the board level only during audits or after something went wrong.

Today, it is a board-level concern, driven by the scale of disruption technology failures can cause and the growing reliance organizations have on complex digital systems.

For channel providers, this shift is particularly important. They are operational partners. When systems fail, customers often call the channel first. That makes digital resilience a boardroom issue for the channel. Digital resilience now sits between both organizations, shaped by decisions made in both customer boardrooms and in the boardrooms of the channel providers that support them.

When resilience moves beyond IT

A single software failure can have immediate consequences. Customers may face lost revenue and operational disruption, with the knock-on effect quickly hitting trust.

For channel providers, the fallout is reputational and commercial. These outcomes go far beyond service-level agreements or technical fixes. They affect multiple organizations at once and quickly reach board level on both sides of the relationship.

Resilience is still often treated as something that can be delegated. IT teams are asked to keep systems running, while boards approve suppliers and contracts without always considering what happens if something fails. Recent technology failures have shown how risky that approach can be, and resilience cannot be an afterthought - it now needs to be part of how organizations make strategic decisions.

Channel providers are well placed to see this first-hand. They understand how customer environments are put together and how quickly a single weak link can cause wider disruption. That visibility gives them insight that customers often lack.

Stay up to date with the latest Channel industry news and analysis with our twice-weekly newsletter

Vendor instability and shared exposure

Modern technology stacks are rarely straightforward, with organizations relying on multiple software suppliers and cloud platforms, many of which sit outside their direct control. If a vendor becomes insolvent or withdraws support, the impact can be immediate.

When this happens, responsibility does not sit with just one organization. Customers feel the operational impact, while channel providers often absorb the reputational and commercial fallout. That shared exposure means resilience cannot be planned in isolation. It requires alignment between customer boards and channel boards, particularly around supplier choice, contracts, and continuity planning.

This is where the channel’s position matters. Sitting between vendors and customers, partners can see both the technical dependencies and the commercial consequences. That puts them in a strong position to raise resilience issues early and help customer boards address them before problems arise.

Resilience as a differentiator

Resilience is often seen as a cost or a safety net, but in an increasingly busy market, it can be an important differentiator compared to competitors. Customers increasingly expect their technology partners to help them anticipate risk, not just react to it. By showing how resilience is built into their services, channel providers are more likely to win trust and long-term business.

This does not require complex frameworks, and actually starts with asking straightforward questions, including within the channel provider’s own boardroom.

What happens if a critical supplier fails? How would systems be maintained or rebuilt? Is there clear evidence that continuity has been considered? These are business questions, not technical ones, and they are exactly the questions customer boards are starting to ask.

Where software escrow fits in

One area that both channel providers and customer boards often overlook is software escrow. Software escrow provides an independent way to ensure that critical software can still be accessed, maintained, and rebuilt if a vendor can no longer support it.

For channel providers, it is a vital product to be able to explain to customers. Not only does it help customers have confidence that continuity has been planned for, but it also reduces the channel’s own exposure to supplier failure. By introducing software escrow earlier in customer conversations, resilience can be addressed before problems arise, rather than after a disruption has occurred.

Many customers recognize that technology risk exists but struggle to turn that awareness into action, and this is where channel providers can add real value. By framing resilience as a business issue rather than a technical one, partners can help customers link digital decisions to commercial outcomes.

That might involve raising resilience during procurement, encouraging clearer supplier governance, or introducing software escrow as part of a broader continuity approach. Each step helps customers move from assumption to assurance.

For the channel, this approach also protects long-term relationships. When disruption occurs, partners who have helped customers plan ahead are far more likely to retain trust.

A shared leadership responsibility

Digital resilience cannot be handled by one side of the relationship. Channel providers and customers share the risk when systems fail, so they need shared expectations about supplier choice and evidence that recovery will work in practice.

That starts in the boardroom, with clear ownership and regular checks that plans are both complete and tested.

When customer and channel boardrooms are aligned, disruption is easier to manage because decisions have been made in advance. Channel providers that help customer boards test assumptions and deal with gaps around supplier failure reduce risk for both sides and earn longer-term trust.

Jayesh Patel has more than 20 years of experience working in senior finance and commercial positions in multinational publicly listed organizations.

He has considerable experience in sales and operational transformation, delivery of large-scale capital programs, and finance leadership in logistics, property, and hospitality.

-

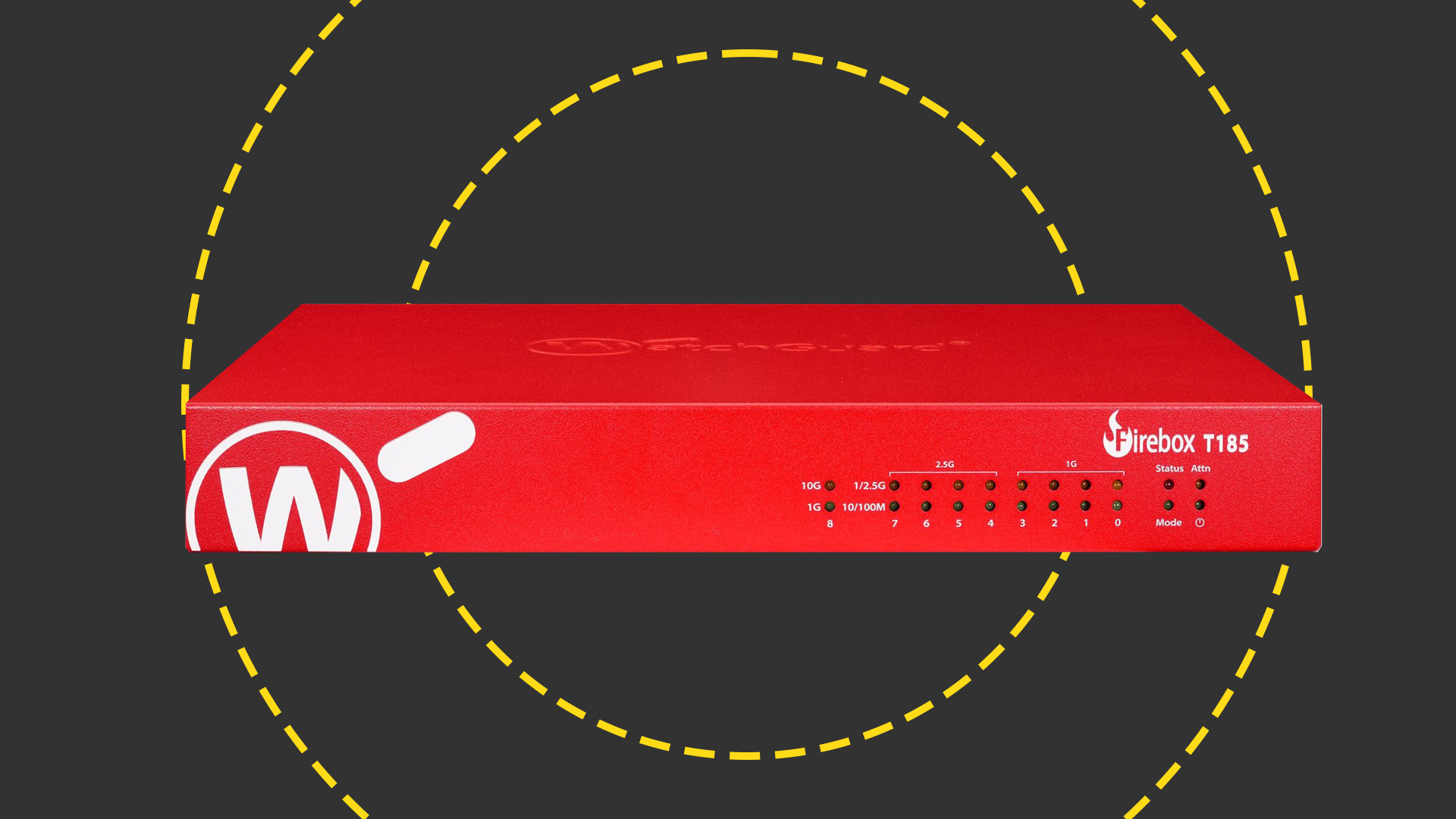

WatchGuard Firebox T185 review

WatchGuard Firebox T185 reviewReviews The Firebox T185 offers a superb range of security measures, smart cloud management, and good performance at a competitive price point

-

The UK government wants to upskill 10 million people in AI by 2030 – and the courses are free to access

The UK government wants to upskill 10 million people in AI by 2030 – and the courses are free to accessNews The nationwide upskilling push aims to help UK workers capitalize on the generative AI boom

-

Beyond the handshake: Building a purpose-built partner economy that solves customer problems

Beyond the handshake: Building a purpose-built partner economy that solves customer problemsIndustry Insights Quality over quantity will set partners up for sustained success…

-

Why trust not tech will decide the channel’s future

Why trust not tech will decide the channel’s futureIndustry Insights When technology looks the same, the real differentiation comes from honesty and long-term relationships

-

How the partnership model can transform the channel

How the partnership model can transform the channelIndustry Insights Collaboration and a shared understanding and commitment to solving problems is key...

-

What the fragmentation of UC means for the channel

What the fragmentation of UC means for the channelIndustry Insights If communications are becoming fragmented, what does that mean for MSPs and VARs?

-

How the UK public sector could benefit from strategic channel partnerships

How the UK public sector could benefit from strategic channel partnershipsIndustry Insights Is the channel the answer to the growing cost vs budget problem facing the public sector?

-

Why MSSPs must train smarter

Why MSSPs must train smarterIndustry Insights Upskilling is key for MSSPs to move from reactive monitoring to measurable risk reduction

-

Platform consolidation is the solution for MSPs’ growing pains

Platform consolidation is the solution for MSPs’ growing painsIndustry Insights As 2025 draws to a close, there's never been a better time for MSPs to rethink their tech structure

-

Is diversity still a challenge in the channel?

Is diversity still a challenge in the channel?Industry Insights Despite progress, diversity remains a challenge in the tech channel, as women represent less than a quarter of the UK’s tech workforce and still face structural and cultural barriers