Will Nvidia's AI dominance shake up the public cloud ‘big three’?

Nvidia continues to make strategic moves to partner with and compete against the largest cloud service providers, with AWS in danger of losing ground

The relatively nascent cloud computing industry entered a slowdown in its meteoric growth this year. As it begins to mature, it now encounters a major challenge in the form of how best to integrate artificial intelligence (AI)-optimized hardware, software, and semiconductor chips.

The ‘big three’ public cloud services – Microsoft Azure, Google Cloud Platform (GCP), and market leader Amazon Web Services (AWS) – may face an existential crisis with the rise of generative AI and the hardware needed to power large language models (LLMs) and other workloads.

Out of these three, AWS is especially vulnerable to losing market share, according to the experts, with another company – Nvidia – holding all the cards.

With its hold on the AI hardware segment, Nvidia is moving quickly to shore up its leverage by deepening partnerships with major cloud providers, apart from one: AWS. This could work to shake up a public cloud market which we had assumed was set.

AWS skips the Nvidia AI party… but at what cost?

Public cloud market leader AWS depended on a four-part approach to create and dominate the public cloud market. This plan included:

- Creating infrastructure according to popularity / demand for services

- Leveraging first-mover advantage

- Making silicon in-house, save billions of dollars

- Controling product end-to-end

This four-part formula served AWS well, says Dylan Patel, chief analyst at SemiAnalysis, but with the advent of AI, another cloud leader emerged. Nvidia, the semiconductor chip designer of choice for high-performance computing (HPC), LLM training and inference, now competes against the companies it also partners with.

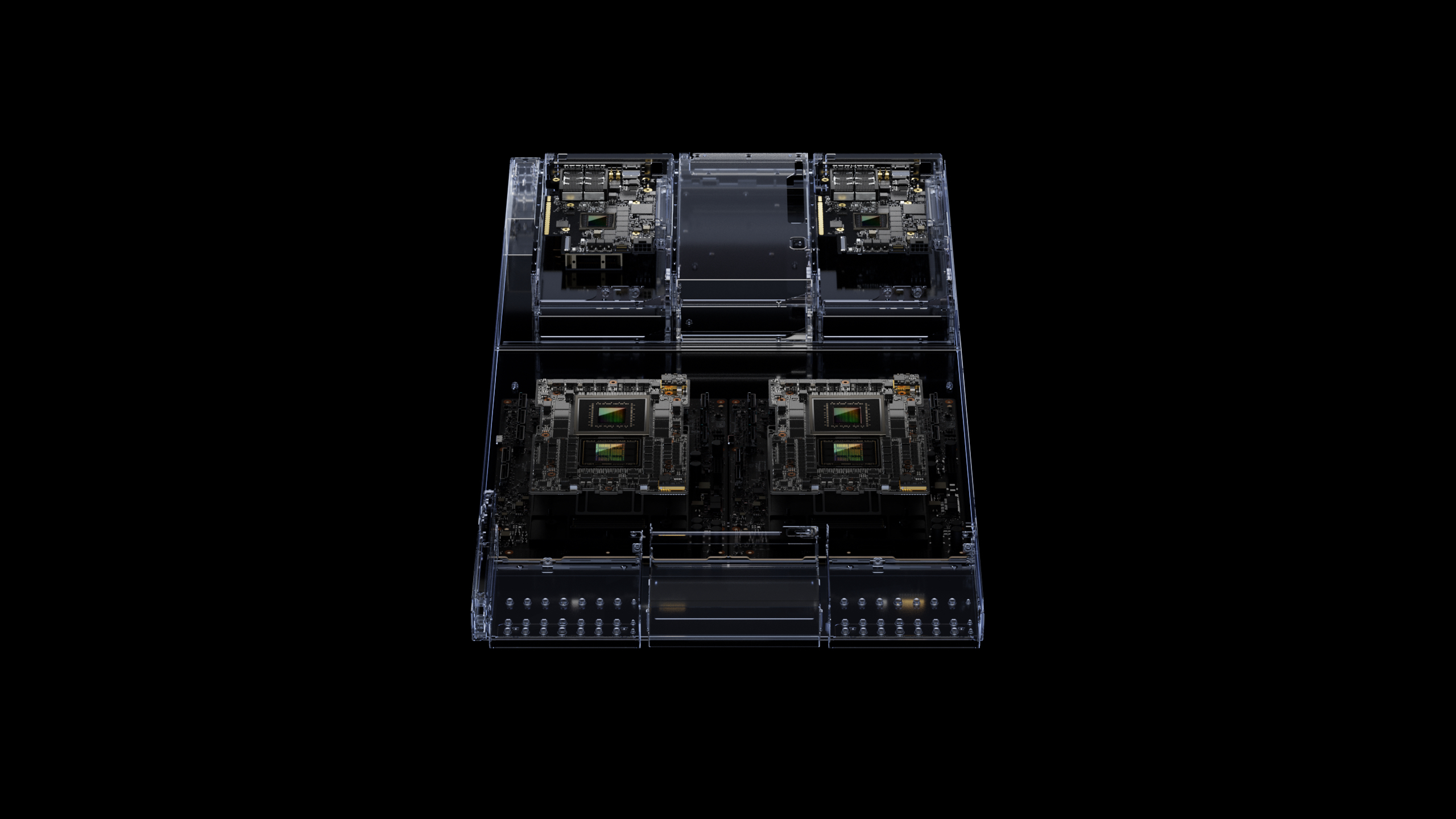

“Nvidia has big ambitions in AI,” says Jay Goldberg, CEO of technology and finance consulting firm D2D Advisory. “It wants to move beyond only selling semiconductors to providing a complete AI solution to end-customers. This includes providing extensive software tools and even its own cloud service.”

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

RELATED RESOURCE

Discover how IBM watsonx.data supports a range of current standard technologies

DOWNLOAD NOW

“We are witnessing an intense competition among these cloud providers to capitalize on the significant revenue opportunities presented by the thriving AI applications,” adds Sameh Boujelbene, VP of data center and campus ethernet switch market research at Dell’Oro Group. “Nvidia is seizing this pivotal moment in the market to leverage its dominance in AI hardware and generate revenue from cloud-based software solutions.

“Nvidia made early investments in AI and deep learning, recognizing their potential long before they became mainstream,” Boujelbene adds. “This head start allowed it to develop and refine its technology to cater specifically to AI applications.”

Networking is key to Nvidia’s cloud ambitions

AWS has resisted this push, and its approach to Nvidia could close the gap between it and its major competitors Azure and GCP. The service of which Goldberg and Boujelbene speak is Nvidia’s AI as a service offering, Nvidia AI. It gives customers access to the power of a supercomputer to train LLM, develop AI inference models, and monitor data.

“So far, Nvidia has been careful to position its cloud computing ambitions in partnership with the public cloud providers,” says Goldberg. “Beyond this, Nvidia's dominant position in AI semiconductors and limited supplies has allowed it to ration allocation of those chips.”

AWS is left out, says Patel, because it refuses to leverage Nvidia’s networking product NVLink. Leveraging the tool would give Nvidia too much control, in the eyes of AWS, Patel tells ITPro.

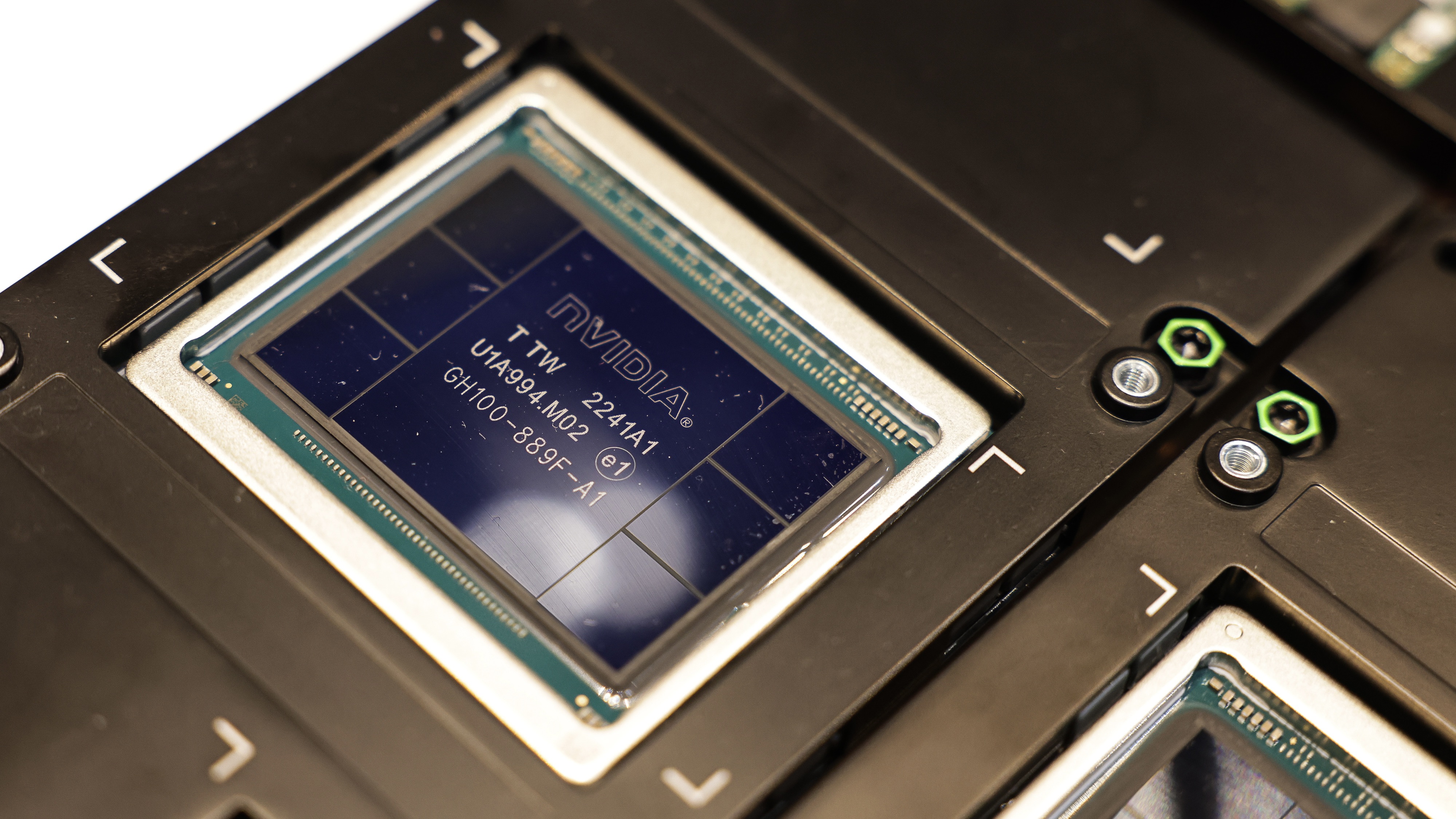

“The new GH200 Grace Hopper Superchip platform] … uses the Grace Hopper Superchip, which can be connected with additional Superchips by NVIDIA NVLink™, allowing them to work together to deploy the giant models used for generative AI…. gives the GPU full access to the CPU memory, providing a combined 1.2TB of fast memory when in dual configuration.”

Networking remains a critical piece of Nvidia’s full-stack solution, according to Boujelbene. In addition to NVLink, Boujelbene points out the firm’s InfiniBand and Ethernet offerings. The H100s can reach 3.5 times their normal performance when using NVLink between GPU nodes, Nvidia claims. He notes AWS isn’t the only one cautious about integrating NVLink.

But, Patel warns, once Nvidia’s much anticipated GH200 Grace Hopper chip arrives, the firm will most likely make NVLink mandatory for other companies to gain access to the chip’s power and performance. Patel has inferred this from Nvidia’s product announcement, in which it all but came out and said NVLink is needed to get the most out of its tools.

How Nvidia is directly challenging cloud providers

Nvidia is using its popular H100 chips as leverage by prioritizing Azure, GCP, and smaller players such as Coreweave, Equinix, and Lambda to receive the first available shipments of the in-demand H100s. By doing so, the firm is folding cloud providers into its cloud ambitions, and AWS sticks out like a sore thumb because it won’t play ball, Patel says.

The demand for H100s comes from the chip’s raw speed in both inference and LLM training. Even with Nvidia’s price spikes, H100s still provide the best performance per dollar from any of the latest GPUs.

AWS occupies an almost too-big-to-fail position in the market, and it can certainly afford stick to its principles and remain in control, but this puts it in the rare position of playing catchup. “Nvidia is the leading provider of GPUs and AI accelerated compute for the cloud services providers,” says Goldberg. “They rely on Nvidia for providing the best GPUs, along with the CUDA software tools, which power the training of AI models.”

To compete, AWS developed its own inference and training software called Trainium and Inferentia, Patel adds. But they’re below standard capabilities, they’re struggling to gain traction in the market, and aren’t competitive after offering steep discounts.

Nvidia is assuming the role of gatekeeper for the ‘big three’ cloud service providers in this AI age. The firm uses its software – CUDA – and hardware – H100 and GH200 – to retain partnerships and pressure holdouts.

Nvidia also struck partnerships with Microsoft, Oracle, Google, and minor players to roll out a lower-margin DGX as a service operation. This gives customers access to Nvidia’s latest suite of cloud-ready systems without needing hardware. According to Patel, AWS is the only major cloud provider not offering Nvidia’s AI as a service model, jeapordizing its position as the market leader.

Lisa D Sparks is an experienced editor and marketing professional with a background in journalism, content marketing, strategic development, project management, and process automation. She writes about semiconductors, data centers, and digital infrastructure for tech publications and is also the founder and editor of Digital Infrastructure News and Trends (DINT) a weekday newsletter at the intersection of tech, race, and gender.

-

What is Microsoft Maia?

What is Microsoft Maia?Explainer Microsoft's in-house chip is planned to a core aspect of Microsoft Copilot and future Azure AI offerings

-

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using it

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using itOpinion If Satya Nadella wants us to take AI seriously, let's start with ROI for businesses

-

What the new AWS European Sovereign Cloud means for enterprises

What the new AWS European Sovereign Cloud means for enterprisesNews AWS has announced the general availability of its European Sovereign Cloud. Here's what the launch means for enterprises operating in the region.

-

AWS just quietly increased EC2 Capacity Block prices – here's what you need to know

AWS just quietly increased EC2 Capacity Block prices – here's what you need to knowNews The AWS price increases mean booking GPU capacity in advance just got more expensive

-

Cloud infrastructure spending hit $102.6 billion in Q3 2025 – and AWS marked its strongest performance in three years

Cloud infrastructure spending hit $102.6 billion in Q3 2025 – and AWS marked its strongest performance in three yearsNews Hyperscalers are increasingly offering platform-level capabilities that support multi-model deployment and the reliable operation of AI agents

-

Google Cloud teases revamped partner program ahead of 2026

Google Cloud teases revamped partner program ahead of 2026News The cloud giant’s new-look partner ecosystem shifts focus from activity tracking to measurable customer outcomes

-

What Palo Alto Networks' $10bn deal with Google Cloud means for customers

What Palo Alto Networks' $10bn deal with Google Cloud means for customersNews The extension of an existing partnership between Palo Alto Networks and Google Cloud is designed to boost security amid rise in AI

-

Cohesity deepens Google Cloud alliance in data sovereignty push

Cohesity deepens Google Cloud alliance in data sovereignty pushNews The pair’s expanded collaboration will focus on new integrations for AI, cybersecurity, and data protection

-

AWS re:Invent 2025 live: All the news and announcements from day two in Las Vegas

AWS re:Invent 2025 live: All the news and announcements from day two in Las VegasLive Blog Keep tabs on all the latest announcements from day-two at AWS re:Invent 2025 in Las Vegas

-

AWS pledges $50 billion to expand AI and HPC infrastructure for US government clients

AWS pledges $50 billion to expand AI and HPC infrastructure for US government clientsNews The company said an extra 1.3 gigawatts of compute capacity will help government agencies advance America’s AI leadership