JPMorgan launches challenger bank Chase in the UK

This expansion aims to put legacy UK banks on the backfoot as they contend with the rise of the likes of Monzo

The US banking firm JPMorgan has launched a digital bank in the UK in an attempt to unsettle legacy British financial giants as they contend with the recent successes of a string of challenger banks.

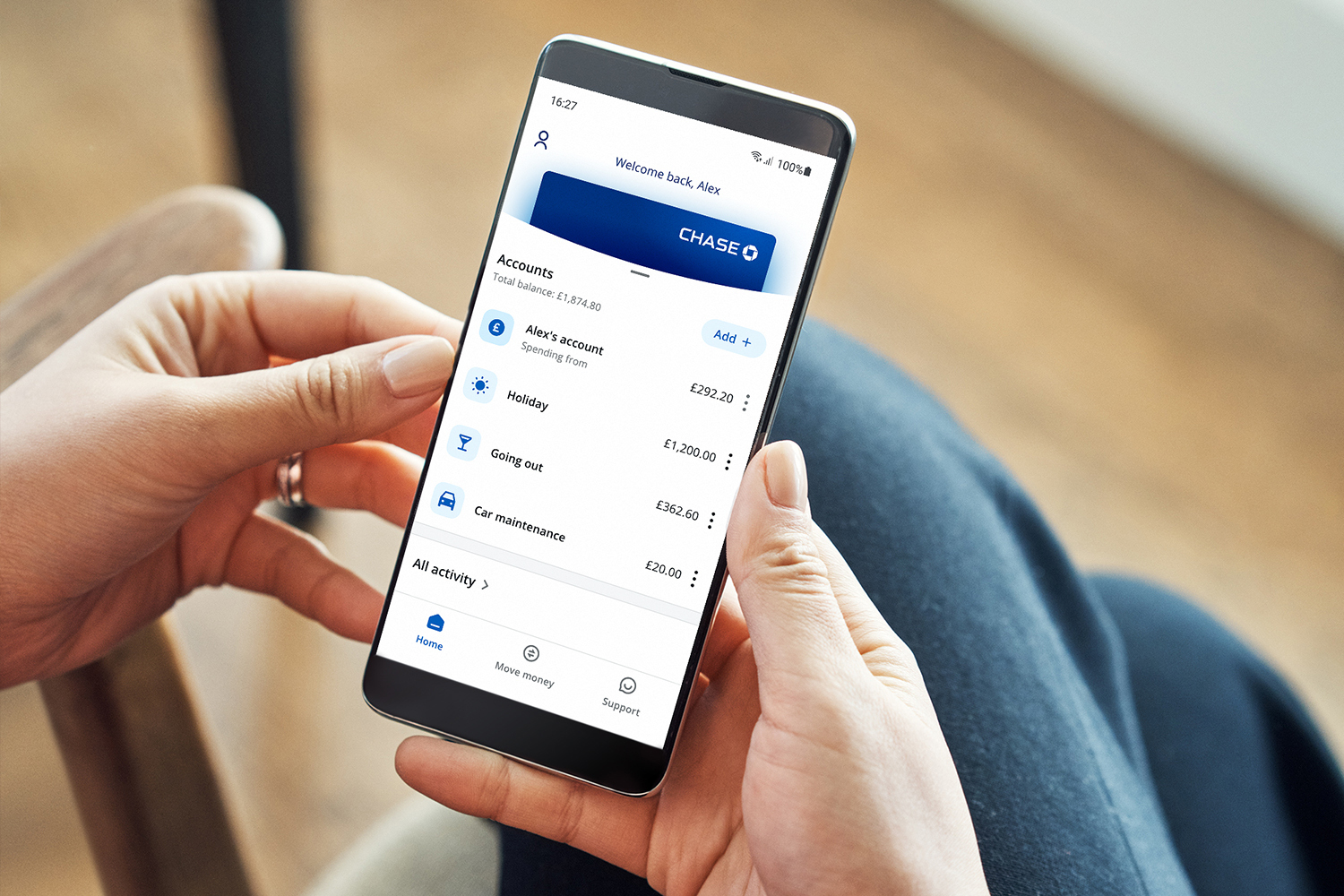

The launch of Chase in the UK marks JPMorgan’s first retail expansion beyond the US and offers UK customers a digital-first current account in the mould of Monzo, Revolut or Starling - backed by the US banking titan.

By signing up and downloading the Chase app, customers will be granted access to a current account within minutes alongside features to help users budget manage money, spend and save. There’ll also be a UK-based customer support team available 24/7.

The launch of Chase puts pressure on legacy UK banking giants such as RBS and Barclays struggling to stem the rapid growth in popularity of the aforementioned challenger banks.

The user base of Monzo, for example, has surged from 150,000 in 2017 to four million in 2020, according to Business of Apps. Starling Bank, too, was recently crowned a UK fintech unicorn, which means its value surpassed the $1 billion mark.

Chase hopes to further turn the screw by launching its app with a number of additional incentives, including “small change round-ups” which allow customers to earn 5% interest for 12 months when rounding up purchases to the nearest £1.

RELATED RESOURCE

Three-step guide to modern customer experience

Support the critical role CX plays in your business

Fee-free debit card usage abroad as well as customisable current accounts, for different spending pots, may also appeal to customers. This is in addition to 1% cashback.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The debit card itself won’t feature a number, interestingly, with card details stored behind a secure login on the Chase app. This means customers who lose the physical card needn’t worry about others making payments using the stolen card.

Traditional banks have tried in recent years to retain their stranglehold on UK customers by launching their own digital alternatives to the challenger banks like Starling.

NatWest-owned RBS launched its own digital-first current account, branded Bó, in February 2020, for example. The service shut down after just six months, however, and absorbed into NatWest’s own challenger bank Mettle, which is aimed at businesses.

Keumars Afifi-Sabet is a writer and editor that specialises in public sector, cyber security, and cloud computing. He first joined ITPro as a staff writer in April 2018 and eventually became its Features Editor. Although a regular contributor to other tech sites in the past, these days you will find Keumars on LiveScience, where he runs its Technology section.

-

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?Analysis Plunging venture capital investment and warnings over high-growth company support raise doubts over the ‘Unicorn Kingdom’ ambition

-

Some Tech Nation programs could continue after Founders Forum acquisition

Some Tech Nation programs could continue after Founders Forum acquisitionNews The acquisition brings to a close a months-long saga over what the future holds for Tech Nation initiatives

-

Podcast transcript: Startup succession: From Tech Nation to Eagle Labs

Podcast transcript: Startup succession: From Tech Nation to Eagle LabsIT Pro Podcast Read the full transcript for this episode of the ITPro Podcast

-

The ITPro Podcast: Startup succession: From Tech Nation to Eagle Labs

The ITPro Podcast: Startup succession: From Tech Nation to Eagle LabsITPro Podcast Some small firms are already lamenting the loss of Tech Nation, but Barclays Eagle Labs has much to offer the sector

-

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never has

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never hasOpinion Tech Nation has a great track record, but Eagle Labs has the experience, the financial clout, and a clear-cut vision that will deliver positive results for UK tech

-

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditions

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditionsNews Tech Nation’s final piece of industry research calls for action to support continued ecosystem growth

-

"It's still not great": Industry divided on government's SMB tax relief package

"It's still not great": Industry divided on government's SMB tax relief packageNews The government’s handling of R&D tax credits has left SMBs with a “sense of disbelief”

-

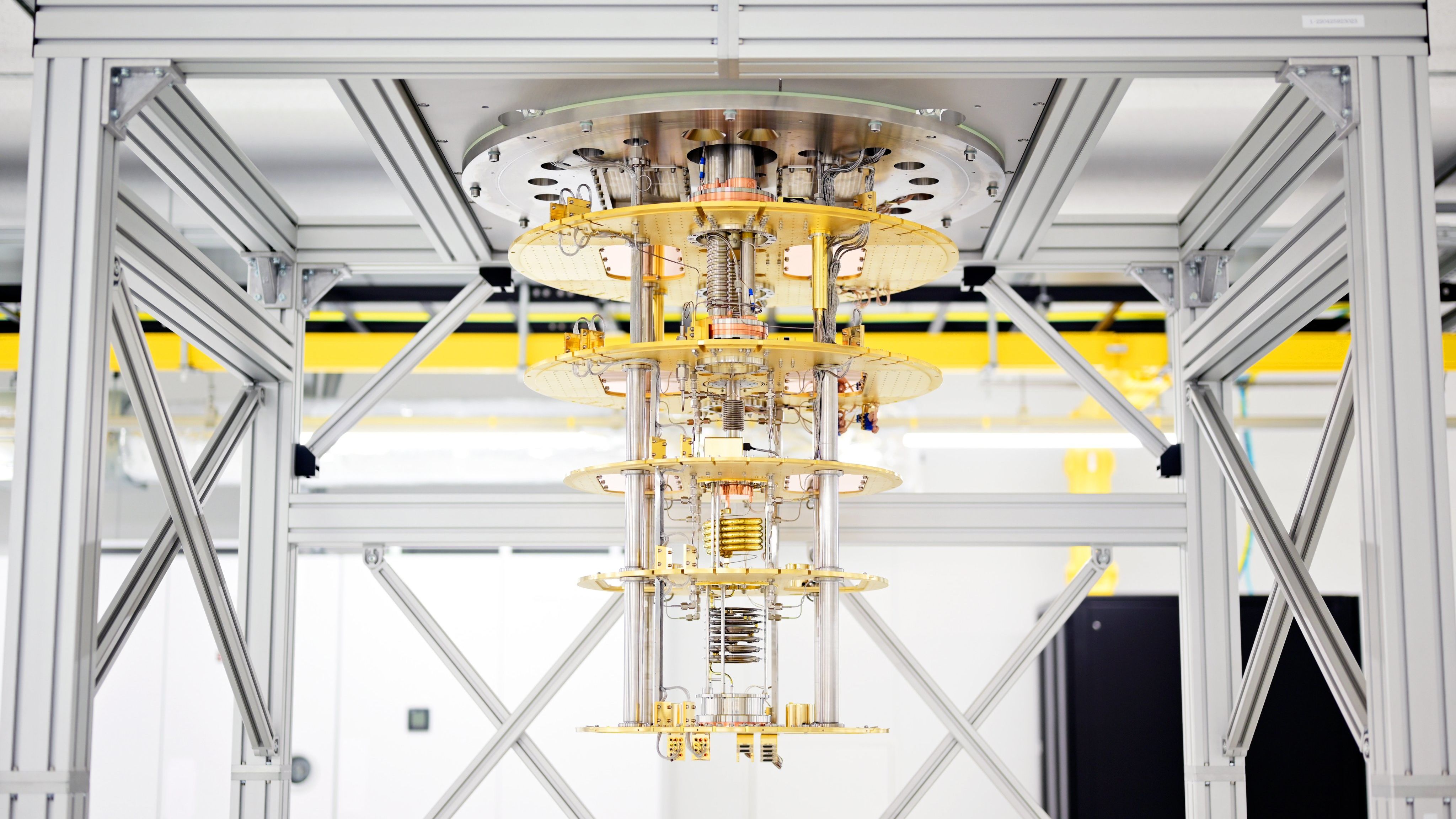

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix